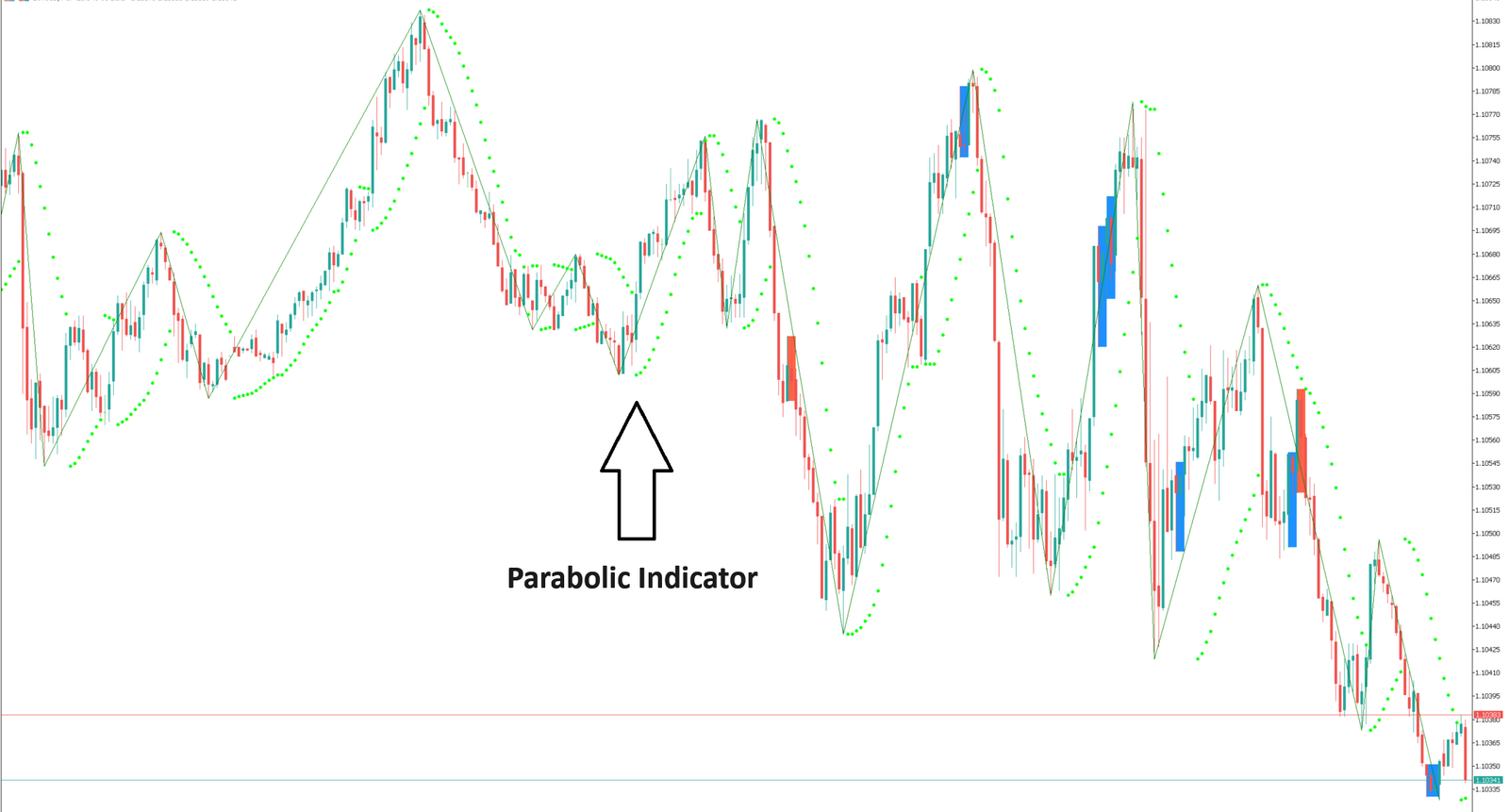

The Parabolic indicator (English name – Parabolic) was created by Welles Wilder and is used to confirm or refute the direction of the trend, correct/sideways trends, and the timing of closing positions. The working principle of this indicator can be explained by the sentence “stop and reverse”.

Using the Parabolic Indicator

When using indicators, you need to pay attention to: the fluctuation of the indicator relative to the stock price, and the acceleration factor of trend development. Although the indicator is widespread, it still has its limitations and often gives false signals in some cases, such as: market When dynamics change frequently.

Signals of the Parabolic indicator:

Trend confirmation

1-Fluctuations below the current price indicate an upward trend;

2-A price fluctuation higher than the current price indicates a downward trend;

Determine when to close a position:

1-During an upward trend, if the indicator is higher than the price fluctuation, long positions need to be closed.

2-During a downward trend, if the indicator is lower than the price fluctuation, short positions need to be closed.

The strength of the signal can be determined by the acceleration factor. During an uptrend, the current closing price is higher than the previous one, or during a downtrend, the current closing price is lower than the previous one, and the acceleration factor accelerates each time. If the price and the indicator fluctuate equally – the indicator is more reliable, while the price and the indicator start to approach each other – not so reliable.