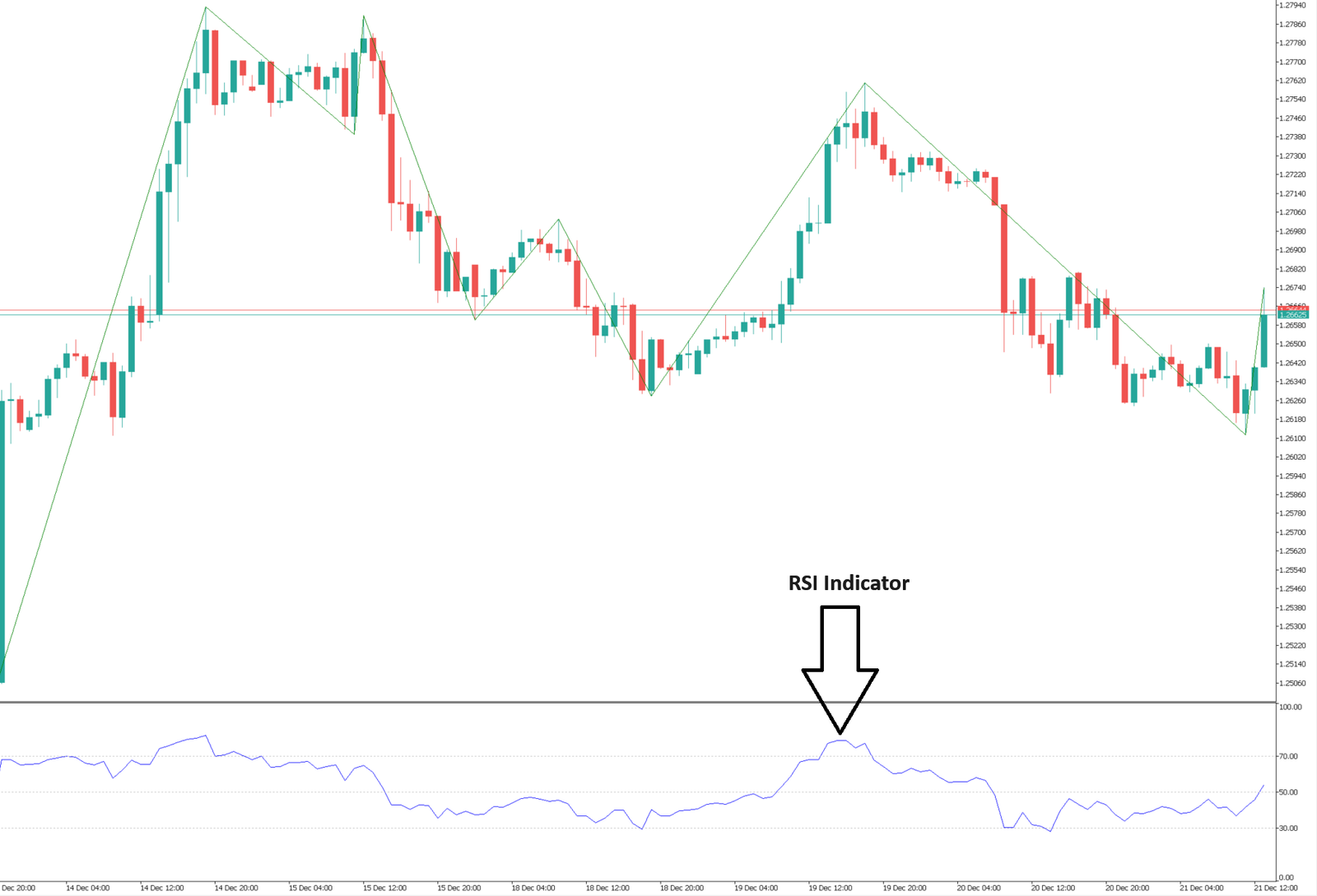

The relative strength index was invented by Welles Wilder. It is used to determine the strength and weakness of the trend. It measures the speed of price change by comparing the positive growth and negative growth of the closing price.

RSI Indicator Utilization

The relative strength index can be used to determine overbought/oversold of an asset, but this index needs to be used together with ordinary trend analysis:

1- RSI exceeds the 70 level – possibility of the asset being overbought;

2- The RSI is below the 30 level – the possibility of the asset being oversold.

Index leaves overbought/oversold territory – a signal that may prove a trend correction or turn:

1- The index crosses the overbought range from top to bottom – a sell signal;

2-The index crosses oversold territory from bottom to top – a buy signal.

Convergence/divergence situations have the potential to prove superior trend weakness:

1- Index fluctuations do not support the price reaching its usual high value – a sign of weakness in the upward trend;

2- Index fluctuations did not support prices reaching routine lows – a sign of weakness in the downtrend.

RSI Trading Strategy

RSI gives a short or long signal. There are two key levels: 30 and 70. If the indicator value is below 30, the market is speculative. If it is above 70, the market is overbought. If a trader is looking for a long entry point, he can wait for the indicator to go below 30. A reversal of the indicator line above 30 indicates a trend reversal. On the contrary, if he is short, he needs to wait for the indicator to go above 70.

Calculate RSI Indicator

RSI = 100 – 100/(1 + RS) RS (14) = Σ(positive growth in stock price)/Σ(|negative growth in stock price|)