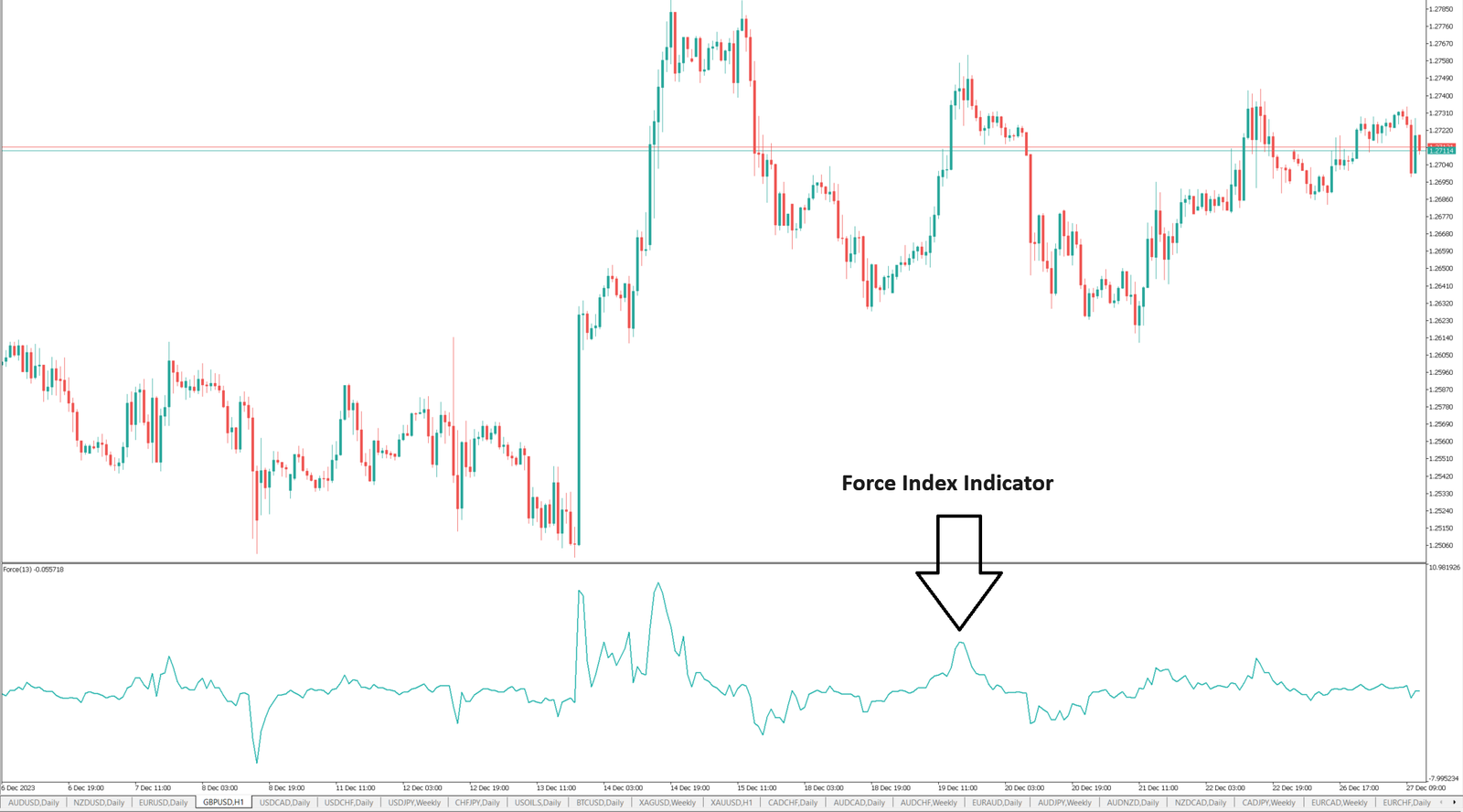

The Force Index indicator was developed by Alexander Elder. The index measures the power of price fluctuations by analyzing the components of price fluctuations (the direction, size and quantity of the fluctuations). The Force Index fluctuates around the zero level, which is the balance point of the price fluctuation components.

Use of Force Index Indicator

The Force Index will prove the trend in any time period:

Regarding the short-term trend, in order to improve the sensitivity of the indicator, it is necessary to reduce the indicator’s period.

Regarding the long-term trend, in order to reduce the sensitivity of the indicator, it is necessary to increase the period of the indicator.

The Force index will prove the stop of the trend:

The positive value of the indicator turns into a negative value and the divergence between the price direction and the indicator direction proves that the upward trend has stopped.

The negative value of the indicator turns into a positive value and the convergence of the price direction and the direction of the indicator proves that the downward trend has stopped.

Trend indicators and Power Index are used together to show market trends and their changes:

Reaching the highest value, the indicator falls confirming the correction of the upward trend.

Reaching the minimum value, the indicator rise confirms the correction of the downward trend.